Day Trade Tips: Maximizing Profit and Minimizing Risk

Introduction:

Day trading, also known as intraday trading, is a popular investment strategy where traders open and close positions within a single trading day. It requires quick decision-making, in-depth market analysis, and effective risk management to succeed. In this article, we will provide a comprehensive overview of day trade tips, exploring what it entails, the different types of strategies used, popular tactics, and quantitative measurements to enhance trading performance.

Understanding Day Trade Tips

Day trade tips encompass various strategies and approaches aimed at capitalizing on short-term price movements in financial markets. Traders rely on technical indicators, market analysis, and real-time data to identify potential trading opportunities and exit with profits before the end of the trading day. The goal is to generate consistent returns by leveraging small price fluctuations.

Types of Day Trade Tips

1. Scalping: This strategy involves making numerous quick trades throughout the day to profit from small price differentials. Scalpers aim to gain a few ticks or pips per trade and accumulate profits over multiple transactions.

2. Momentum Trading: Traders using this strategy capitalize on strong price movements and trends that occur within a short timeframe. By identifying stocks or assets experiencing significant momentum, traders aim to ride the wave and exit positions before the trend reverses.

3. Rebate Trading: This approach involves taking advantage of rebates offered by market makers for providing liquidity. Traders actively engage in buying and selling stocks or other assets, earning a profit on the rebates received.

4. Breakout Trading: Traders utilizing breakout strategies focus on identifying key price levels, such as support or resistance levels. When a stock breaks out of these levels with high volume, it signals a potential significant price movement, which traders try to take advantage of.

Quantitative Measurements for Day Trade Tips

Quantitative measurements play a crucial role in evaluating the effectiveness of day trading strategies. Here are some key metrics to consider:

1. Win-Rate: The win-rate measures the percentage of trades that result in a profit. It is essential to maintain a high win-rate to ensure profitable trading over time.

2. Risk-Reward Ratio: This ratio compares the potential profit of a trade to the amount at risk. Day traders typically aim for a favorable risk-reward ratio, where the potential profit outweighs the potential loss.

3. Average Profit per Trade: Calculating the average profit per trade allows traders to assess the effectiveness of their strategy and make necessary adjustments if needed.

4. Maximum Drawdown: The maximum drawdown measures the largest percentage decline in an account from its peak value. Traders should strive to minimize drawdowns to protect their capital.

Differentiating Day Trade Tips

The various day trade tips mentioned earlier differ in their approach and risk profiles. Scalping, for instance, focuses on small, frequent trades and relies heavily on technical analysis, whereas momentum trading seeks to capitalize on strong price movements and trends. Rebate trading, on the other hand, involves actively trading for rebates rather than focusing solely on price movements.

Historical Pros and Cons of Day Trade Tips

Just like any investment strategy, day trading has its advantages and disadvantages. Let’s delve into the historical context:

1. Pros:

– Potential for substantial profits within a short timeframe.

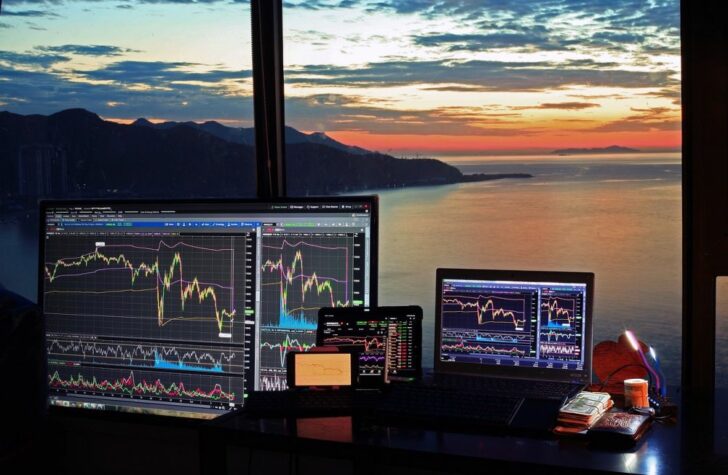

– Flexibility and independence as traders can work from anywhere with an internet connection.

– Access to real-time market data and advanced trading tools.

2. Cons:

– High volatility and increased risk due to short holding periods.

– Psychological pressure and emotional rollercoaster as traders make quick decisions.

– Potential for significant losses if risk management is not properly implemented.

Conclusion:

Day trade tips offer a range of strategies to exploit short-term price movements in financial markets. Traders must thoroughly understand the different types of day trading approaches and choose the one that aligns with their risk tolerance, market knowledge, and personal preferences. By applying quantitative measurements and historical analysis, traders can improve their chances of maximizing profits and minimizing risks. However, careful consideration of the pros and cons is crucial before embarking on a day trading journey.